Passed Over for a Promotion: Is It Discrimination?

Discrimination is a possible explanation if your employer passed you over for a promotion you believe you earned. Consider the possibility that your employer discriminated

But standing up for yourself is scary.

You may be going against a massive company–a company that oppressed you and doesn’t care. The same company that thinks you’re expendable.

Your employer would like nothing more than for you to sit back, quiet down, and decide there’s “nothing you can do” about their bullying. They want you to disappear.

But you’re determined. You’re not going to let them bully you into silence.

And here’s the good news…

You don’t need to do this alone.

With the help of a San Diego employment lawyer from Haeggquist & Eck, you can fight back. You can have one of the nation’s most successful and powerful employment law firms on your side. Fighting for you, standing up for you, and doing the hard work for you.

So you can get the justice and recovery you deserve and get your life back together stronger than ever.

This means that 99% of clients we take on receive a settlement or win

a judgment at court. Are you ready to be our next success story?

We are a rare women-owned law firm. Nearly every one of our partners is a woman. While we enthusiastically represent clients of all genders, the overwhelming majority of our clients are women who have suffered egregious wrongs at the hands of their employers. If you’re a woman seeking representation, we know how sensitive a topic this is for you, and our founder Alreen Haeggquist founded this firm to serve women just like you. We “get” your situation personally. Like most work fields in America, the legal field is male-dominated. We know what it’s like to be underestimated. We will fight for your success just like we have fought for our own power and success in the legal field. No one will ever underestimate you again.

I am beyond grateful to Alreen Haeggquist and Jenna Rangel who represented my case. Not only are they extremely knowledgeable and professional but they sincerely cared about my wellbeing and understood the severity of my circumstance. As much as this path I was on was challenging, they tirelessly fought which gave me strength to carry me through. Their diligence, legal expertise and zealous advocacy led to a successful settlement and a new beginning to my life!

You’ll never pay us a penny out of your pocket. We’re going to do everything we can to gain you a significant financial recovery, and we only get paid out of that recovery. 100% of the financial risk is on us, which means you can sleep easy at night. The last thing you need to worry about is legal bills, which is why you’ll never receive one from us!

We have represented plaintiffs in employment claims against such major corporations as Kaiser Permanente, Trader Joe’s, Sharp Healthcare, Wyndham, and the Grand Del Mar. In 2017, our jury trial verdict in a disability discrimination case against Kaiser Permanente was awarded one of the Top 50 Employment Verdicts in California.

We have also served as class counsel in the high-profile consumer fraud litigation against presidential contender Donald Trump and Trump University, which settled in November 2016 for $25 million. The settlement was deemed one of California’s Top 50 Class Action Settlements in 2016.

If we can stand up and win against Donald Trump, we’ll stand up to whoever is bullying you at work and win too.

Our attorneys only take on about 15 cases at a time. (In contrast, many law firms burden their attorneys with up to 100 cases at a time.) When you work with us, your attorney will be thinking about your case day and night. You’re not just another case to us—you’re the lifeblood of our work. You’re a human being who has gone through a difficult and unfair experience, and you deserve restitution and justice. And we will do everything we can to win you the justice and restoration you deserve.

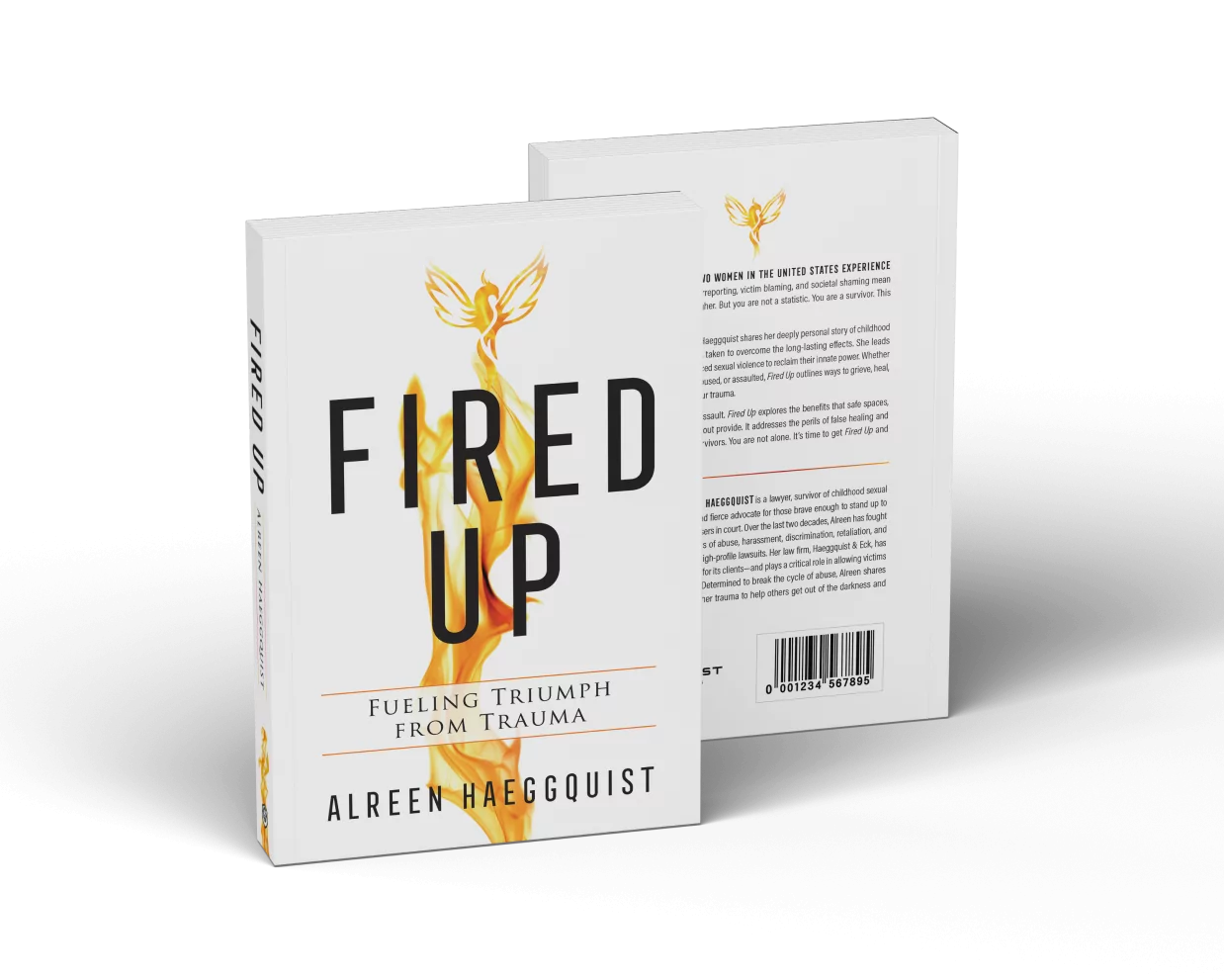

I speak out when somebody is being abused or victimized. I don’t care who the abuser is or what position they are in; I stand up to them. My childhood shaped me to be this way.

I was born in Pakistan, the youngest of 10 kids. My family is Indian. My father had an arranged marriage with my mother. When Burma became communist, they fled, which led to our family moving to the San Fernando Valley. In this new country, we were what I’d call ‘American poor,’ until my high school years when my parent’s business matured.

Visit our firm in Downtown San Diego at 225 Broadway #2050, between 2nd and 3rd Avenue. In addition, we are dedicated to serving clients in a wide variety of communities throughout the area.

Alta Vista (92114), Barrio Logan (92113), Carmel Valley (92130), City Heights (92105), Clairemont (92117), Del Mar Heights (92014), Encanto (92114), Golden Hill (92102), Hillcrest (92103), Kearny Mesa (92123), La Jolla (92037), Linda Vista (92111), Logan Heights (92113), Mira Mesa (92126). Mission Hills (92103), Mission Valley (92108), Normal Heights (92116), North Park (92104), Ocean Beach (92107), Pacific Beach (92109), Point Loma (92106), Rancho Bernardo (92128), Scripps Ranch (92131), Sorrento Valley (92121), South Park (92102), University City (92122).

“ They made me feel safe they said they were there to help me and that kind of gave me some relief ”

Thank you for taking my case and for fighting hard on my behalf. I am lucky to have found your firm and grateful that you took my case.

Your professional approach and seasoned advice were instrumental in bringing my issues…to an amicable and speedy resolution and will long be remembered.

We couldn’t have picked a better partner to help us navigate the complicated and ever-changing legal landscape of State & Federal Employment Law. Thank you HE Law, we find great comfort in knowing you’re on our side. We overwhelmingly recommend your counsel.

When the judge tells us, ‘you have a great attorney’ – that’s a great thing to hear. I recommend Haeggquist & Eck to anybody needing legal representation.

When the judge tells us, ‘you have a great attorney’ – that’s a great thing to hear. I recommend Haeggquist & Eck to anybody needing legal representation.

Discrimination is a possible explanation if your employer passed you over for a promotion you believe you earned. Consider the possibility that your employer discriminated

You can prove race discrimination by proving you are part of a protected group and that someone took adverse action against you based on your

In today’s diverse world, workplaces are melting pots of cultures, beliefs, and traditions. However, while enriching, this diversity sometimes leads to challenges, including religious discrimination.

Both California and federal laws aim to protect employees, but there are key differences. California often offers broader protections and rights for workers. For instance, California's minimum wage and overtime rules are more expansive than federal regulations. Additionally, while both jurisdictions prohibit discrimination and harassment based on specific protected categories, California recognizes a wider array of protected characteristics, such as gender expression and marital status. Also, California's Family Rights Act provides certain leave rights that are distinct from the federal Family and Medical Leave Act. Consult with a San Diego employment attorney familiar with both sets of laws to understand your rights and any potential claims fully.

If you believe you've been wrongfully terminated, take immediate steps to protect your rights. Begin by documenting all relevant events, conversations, and correspondence leading up to your termination. Save emails, text messages, or any other form of communication. Avoid discussing the matter on social media or with colleagues, as it may complicate your case. An experienced employment attorney can provide guidance on the legal aspects of your situation, inform you of your rights, and outline potential steps for recourse.

Workplace discrimination occurs when an employer treats an individual unfavorably based on certain protected characteristics. In California, these protected categories include race, color, national origin, religion, gender (including pregnancy, childbirth, and related medical conditions), disability, age (40 and older), citizenship status, marital status, sexual orientation, gender identity, gender expression, and genetic information, among others. Discrimination can manifest in various employment decisions, including hiring, firing, promotions, training opportunities, wage practices, and more. Remember that subtle forms of discrimination, like bias in assignments or training opportunities, can be just as illegal as more overt acts. Our attorneys will hear your story with sensitivity and full confidentially, ensuring that your rights are protected, and your needs are advocated for at every stage of your case.

If you experience workplace harassment, you should first understand that you are in no way to blame for what happened. However, by documenting the harassment in detail, including dates, times, locations, witnesses, and the nature of each incident, you can empower yourself to seek justice for this wrongdoing. Whenever possible, communicate your discomfort or objections to the harasser directly, provided you feel safe doing so. Report the behavior to your immediate supervisor, human resources department, or as directed by your company's anti-harassment policy. Ensure your report is in writing, and keep a copy for your records. Finally, consult with an employment attorney as soon as possible to understand your legal options and rights.

Both California and federal laws provide strong protections for employees against retaliation. It's illegal for employers to retaliate against employees for engaging in "protected activities," which include filing a complaint about discrimination or harassment, participating in an investigation or lawsuit related to such claims, or opposing discriminatory practices. Retaliation can take many forms, such as demotion, reduction in pay, negative performance reviews, increased scrutiny, or exclusion from training or career advancement opportunities. If you've been retaliated against, document all relevant incidents and consult with an employment attorney right away. Legal timelines for addressing retaliation can be tight, and working with a lawyer experienced in workplace law will ensure that you can act decisively.

Get more real, honest answers from a legal professional who cares about your well-being by calling us today.